Supplemental application period runs from Feb. 26 through April 10

The Internal Revenue Service today announced it will accept supplemental applications from all qualified organizations for Low Income Taxpayer Clinic (LITC) matching grants from Feb. 26 to April 10.

“LITCs help protect taxpayer rights and ensure justice for thousands of taxpayers across the country,” said National Taxpayer Advocate Erin M. Collins. “Some communities that are underserved, or do not have any clinics to help those taxpayers who have nowhere else to turn, need the assistance that a clinic can provide. The supplemental grant period is a chance for eligible organizations to apply for funding that can help make a difference for vulnerable taxpayers and grow the LITC presence in areas with the greatest need.”

The funding and the period of performance for the grant will be July 1 to Dec. 31. Under Internal Revenue Code (IRC) section 7526, the IRS awards matching grants to qualifying organizations to develop, expand or maintain an LITC. For every dollar of funding awarded by the IRS, an LITC must have a dollar of match. An LITC must provide services for free or for no more than a nominal fee (except for reimbursement of actual costs incurred).

LITCs ensure the fairness and integrity of the tax system for taxpayers by:

- Providing pro bono representation to assist low-income taxpayers in resolving tax disputes with the IRS;

- Educating taxpayers for whom English is a second language (ESL taxpayers) about their rights and responsibilities as taxpayers; and

- Identifying and advocating on issues that impact these taxpayers.

To achieve maximum access to justice for low-income and ESL taxpayers, the IRS has expanded the eligibility criteria for a grant by removing the requirement for eligible organizations to provide direct controversy representation. Representation may be provided by referring taxpayers to qualified representatives who have agreed to handle the referred cases on a pro bono basis. In addition, pursuant to the ESL Education Pilot Program started in 2023 and continuing for 2024, a grant may be awarded to an organization to operate a program to inform ESL taxpayers about their rights and responsibilities under the IRC without the requirement to also provide tax controversy representation to low-income taxpayers. See IRS Publication 3319 for examples of what constitutes a “clinic.”

Although the amount and timing of 2024 appropriations is not yet known, the President’s 2024 budget request includes a continuation of LITC funding at $26 million and a $200,000 per award funding cap, and funding bills approved by the House and Senate Appropriations Committees contains similar language. Consistent with the Administration’s budget request and House and Senate action to date, the IRS will allow applicants to request grants up to $200,000. If Congress does not continue the LITC Program’s funding at $26 million and/or the increased per award funding cap of $200,000, the IRS will adjust awards to reflect any limitations in place at that time.

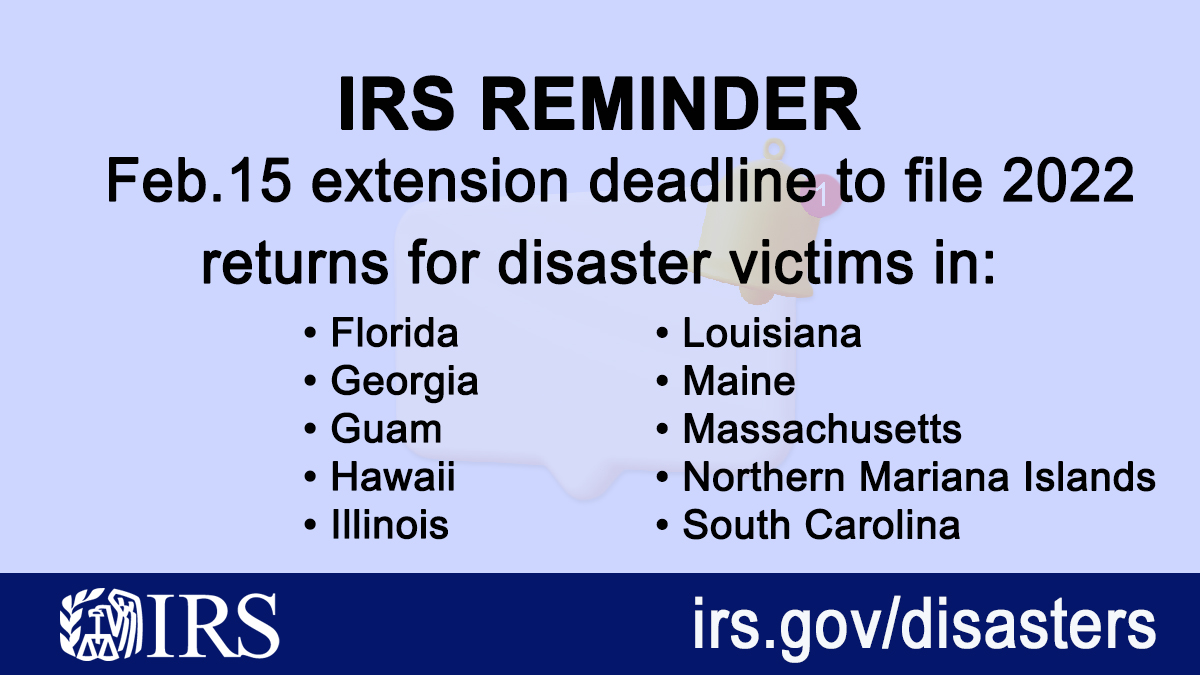

Despite the IRS’s efforts to foster parity in availability and accessibility when choosing organizations to receive LITC matching grants, there remain communities that are underserved by clinics. Currently, the states of Hawaii, Kansas, Nevada, North Dakota, South Dakota, West Virginia and the territory of Puerto Rico do not have an LITC. The IRS is particularly interested in receiving supplemental applications from organizations that provide services in these underserved geographic areas. Priority will be given to established organizations that can help provide coverage to underserved geographic areas. For the ESL Education Pilot Program, special consideration will be given to established organizations with existing community partnerships that can deliver services to the target audiences.

The LITC Program is administered by the Office of the Taxpayer Advocate at the IRS, led by National Taxpayer Advocate Erin M. Collins. Although LITCs receive partial funding from the IRS, LITCs, their employees and their volunteers operate independently of the IRS.

Supplemental applications must be submitted electronically by 11:59 p.m. Eastern Time on April 10, 2024. The funding number is TREAS-GRANTS-052024-002. Copies of IRS Publication 3319, 2024 Grant Application Package and GuidelinesPDF, can be downloaded from IRS.gov or ordered by calling 800-TAX-FORM (800-829-3676). To assist organizations in applying for funding, a “Reminders and Tips for Completing Form 13424-M” document is available on the LITC grants page. Questions about the LITC Program or the supplemental grant application process can be addressed to the LITC Program Office by email at litcprogramoffice@irs.gov. Alternatively, you may contact Karen Tober by email at karen.tober@irs.gov.

More information about LITCs and the work they do to represent, educate and advocate on behalf of low-income and ESL taxpayers is available in IRS Publication 5066, LITC Program ReportPDF. A short video about the LITC Program is also available on the IRS website.

Join the LITC Program Office for one of two optional webinars, where it will provide information about the LITC Program and the supplemental application process. Details on the dates and times of the webinars are available at LITC Grants – Taxpayer Advocate Service.

Source: IRS-2024-50, Feb. 26, 2024