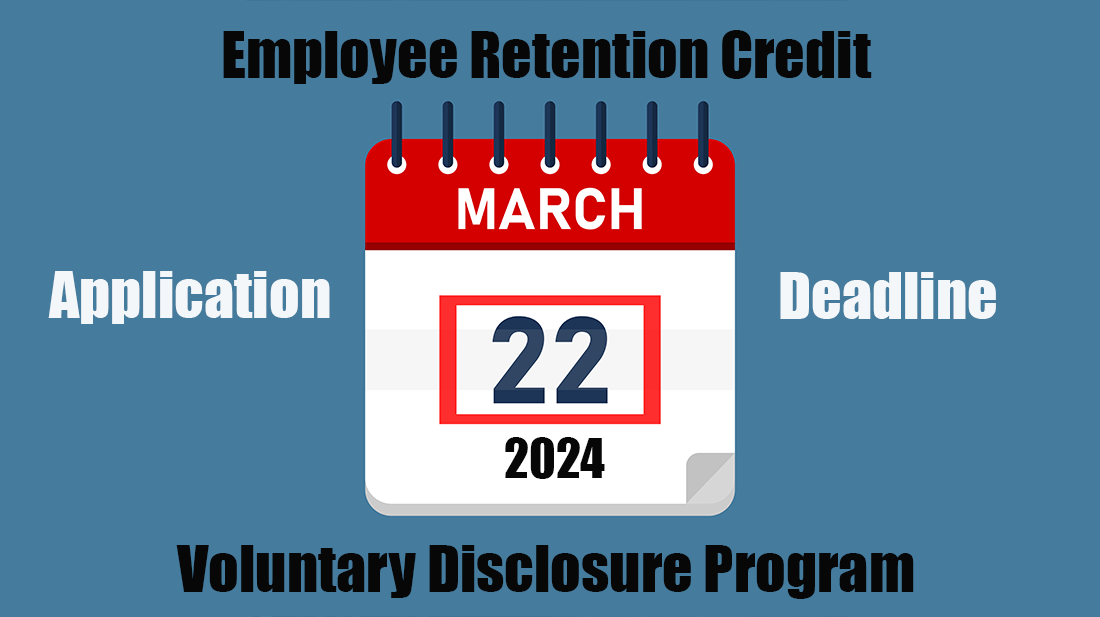

March 22 deadline approaching to resolve incorrect Employee Retention Credit claims; IRS urges businesses to review questionable claims to avoid future compliance action

With a key March 22 deadline rapidly approaching, the Internal Revenue Service renewed calls for businesses to review the Employee Retention Credit (ERC) guidelines to avoid future compliance action for improper claims.

Amid aggressive marketing that misled many businesses into filing claims for ERC, the IRS has sharply increased compliance action through audits and criminal investigations – with more activity planned in the future. To help those who were misled, the IRS has made a limited-time offer available to employers through March 22 to correct improper claims at a sharp discount.

“The window of opportunity is closing for those with questionable claims to fix things before they receive follow-up compliance action,” said IRS Commissioner Danny Werfel. “We strongly urge businesses to review the Employee Retention Credit guidelines immediately before a key disclosure program closes, especially if they encountered a high-pressure push to apply for these credits. Taking action now will avoid potentially hefty penalties and interest if the IRS takes action later. The deals available now are good, and the cost and risk for bad claims will sharply escalate over time.”

Employers who improperly claimed ERC can avoid penalties and interest – and even get a discount on repayments if they apply by March 22, 2024, to the ERC Voluntary Disclosure Program. The IRS also offers a special claim withdrawal process for businesses whose claim is still pending. Taking steps now to resolve these issues can help businesses get right and avoid future IRS actions.

The IRS is urging this review because some ERC promoters shared misleading information or misrepresented eligibility rules and lured businesses to apply for the ERC when they didn’t qualify. Some promoter groups may have called the credit by another name, such as a grant, business stimulus payment, government relief or other names, so even if the terms Employee Retention Credit and Employee Retention Tax Credit don’t sound familiar, businesses should still review their records.

The IRS has two programs to voluntarily resolve improper claims and reduce costs and follow-up steps for businesses who fell for misinformation and aggressive marketing about the ERC.

- The ERC Voluntary Disclosure Program, available through March 22, 2024, is for employers who need to repay ERC they received by December 21, 2023, either as a refund or as a credit on a tax return. This option lets a taxpayer repay the incorrect ERC, minus 20 percent, for any tax period they weren’t eligible for ERC. Generally, businesses who enter this program don’t have to amend other returns affected by the incorrect ERC and don’t have to repay interest they received from the IRS on an ERC refund.

- Businesses should quickly pursue the claim withdrawal process if they need to ask the IRS not to process an ERC claim for any tax period that hasn’t been paid yet. Taxpayers who received an ERC check but haven’t cashed or deposited it can also use this process to withdraw the claim and return the check. The IRS will treat the claim as though the taxpayer never filed it. No interest or penalties will apply.

After these programs end, the IRS will continue a wide range of tax compliance activities on ERC claims to protect taxpayers and enforce the tax law. If the IRS finds an ERC claim to be incorrect after these programs end, the agency can disallow unpaid claims or require repayment with penalties and interest from taxpayers who received ERC. The taxpayer also may need to amend related returns. The IRS is required to use a variety of collection tools to recapture incorrect ERC payments or credits.

“We have good solutions for taxpayers to do the right thing now and avoid hassles and expenses for themselves later – but March 22 is rapidly approaching,” Werfel said. “The domino effect of an incorrect claim can cost a business valuable time, energy and money down the road. We urge businesses to talk to a trusted tax professional and review their situation.”

Under the ERC Voluntary Disclosure Program, a business that incorrectly claimed and received $50,000 for a tax period when it wasn’t entitled to ERC would need to repay only $40,000 after the program’s 20% discount – and no penalties or interest if the taxpayer pays the amount in full.

Alternatively, if the business doesn’t apply to the VDP and the IRS identities an incorrect claim, the business would owe $50,000, and might also owe penalties and interest computed from the date the business received the ERC. For some, this was two to three years ago. Interest compounds daily and the failure-to-pay penalty accrues monthly and can build to 25%. Other penalties could apply to certain situations. So that’s $50,000 – plus possibly penalties and compounding interest, which is far more costly compared to the voluntary options available. A business in this situation may also need to amend related returns, which can add more cost.

Some promoters told taxpayers every employer qualifies for ERC. The IRS and the tax professional community emphasize that this is not true. Eligibility depends on specific facts and circumstances. The IRS has dozens of resources to help people learn about and check ERC eligibility and businesses can also consult their trusted tax professional. Key IRS materials include:

- ERC Eligibility Checklist (interactive version and a printable guidePDF) includes cautions about common areas of misinformation and links to facts and examples.

- 7 warning signs ERC claims may be incorrect outlines tactics that unscrupulous promoters have used and why their points are wrong.

- Frequently asked questions about the Employee Retention Credit includes eligibility rules, definitions, examples and more.

Businesses that can’t pay in full can apply to ERC Voluntary Disclosure Program

Taxpayers who can’t pay the full amount of ERC, minus 20%, by the time they return their signed closing agreement can still apply to the ERC Voluntary Disclosure Program and request an Installment Agreement to pay over time. Businesses who need an installment plan need to submit Form 433-B, Collection Information Statement for BusinessesPDF with their VDP application by March 22 along with any required documents to support it. They also may need a signed Form 2750, Waiver Extending Statutory Period for Assessment of Trust Fund Recovery PenaltyPDF. See Payment options for accepted ERC-VDP applications for details.

If a taxpayer is unable to pay the full amount of ERC, minus 20%, then an IRS collection team member will be assigned the case after the closing agreement is executed and will look to offer a resolution that fits the taxpayer’s current financial condition and ability to pay.

Under an Installment Agreement, the business must make monthly payments. Interest and penalties that normally apply to a tax liability will apply starting from the ERC Voluntary Disclosure Program closing agreement date. This date, however, is better for businesses than an agreement outside of the ERC Voluntary Disclosure Program where the penalties and interest date back to when the business received the incorrect ERC.

Processing updates

On Sept. 14, 2023, amid concerns about aggressive ERC marketing, the IRS announced a moratorium on processing new claims. A specific resumption date hasn’t been determined.

The IRS continues to process ERC claims submitted before the moratorium, but with more scrutiny and at a much slower rate than before the agency’s approach changed last year.

Source: IRS-2024-72, March 15, 2024