IRS reminder: 2024 first quarter estimated tax payment deadline is April 15

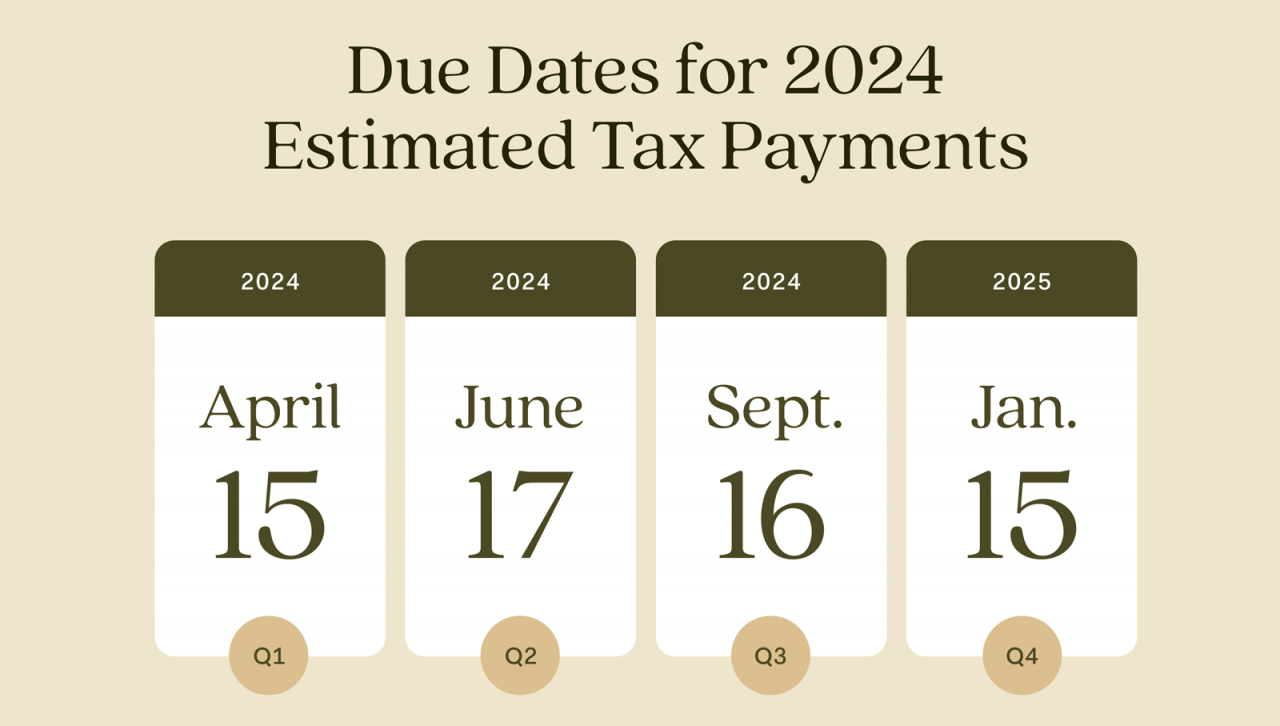

The Internal Revenue Service today advised taxpayers, including self-employed individuals, retirees, investors, businesses and corporations about the April 15 deadline for first quarter estimated tax payments for tax year 2024.

Since income taxes are a pay-as-you go process, the law requires individuals who do not have taxes withheld to pay taxes as income is received or earned throughout the year. Most people meet their tax obligations by having their taxes deducted from their paychecks, pension payments, Social Security benefits or certain other government payments including unemployment compensation.

Generally, taxpayers who are self-employed or in the gig economy are required to make estimated tax payments. Likewise, retirees, investors and others frequently need to make these payments because a significant portion of their income is not subject to withholding.

When estimating quarterly tax payments, taxpayers should include all forms of earned income, including part-time work, side jobs or the sale of goods or services commonly reported on Form 1099-K.

Income such as interest, dividends, capital gains, alimony and rental income is normally not subject to withholding. By making quarterly estimated tax payments, taxpayers can avoid penalties and uphold their tax responsibilities.

Certain groups of taxpayers, including farmers and fishers, recent retirees, individuals with disabilities, those receiving irregular income and victims of disasters are eligible for exceptions to penalties and special regulations.

Following recent disasters, eligible taxpayers in Tennessee, Connecticut, West Virginia, Michigan, California and Washingtonhave an extended deadline for 2024 estimated tax payments until June 17, 2024. Similarly, eligible taxpayers in Alaska, Maineand Rhode Island have until July 15, 2024, and eligible taxpayers in Hawaii have until Aug. 7, 2024. For more information, visit Tax relief in disaster situations.

In addition, taxpayers who live or have a business in Israel, Gaza or the West Bank, and certain other taxpayers affected by the terrorist attacks in the State of Israel, have until Oct. 7, 2024, to make estimated tax payments.

Paying estimated taxes

Taxpayers can rely on Form 1040-ES, Estimated Tax for Individuals, for comprehensive instructions on computing their estimated taxes.

Opting for the IRS Online Account streamlines the payment process, allowing taxpayers to view their payment history, monitor pending payments and access pertinent tax information. Taxpayers have several options to make an estimated tax payment, including IRS Direct Pay, debit card, credit card, digital wallet or the Treasury Department’s Electronic Federal Tax Payment System (EFTPS).

To pay electronically and for more information on other payment options, visit IRS.gov/payments. If paying by check, be sure to make the check payable to the “United States Treasury.”

Publication 505, Tax Withholding and Estimated Tax, offers detailed information for individuals navigating dividend or capital gain income, alternative minimum tax or self-employment tax, or who have other special situations.

Tax Withholding Estimator

The IRS recommends taxpayers use the Tax Withholding Estimator tool to accurately determine the appropriate amount of tax withheld from paychecks.

Regularly monitoring withheld taxes helps mitigate the risk of underpayment, reducing the likelihood of unexpected tax bills or penalties during tax season. It also allows individuals to adjust withholding upfront, leading to larger paychecks during the year and potentially smaller refunds at tax time.

Filing Options

The IRS encourages people to file their tax returns electronically and choose direct deposit for faster refunds. Filing electronically reduces tax return errors because tax software does the calculations, flags common errors and prompts taxpayers for missing information.

The IRS offers free online and in-person tax preparation options for qualifying taxpayers through the IRS Free File program and the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs.

In addition, the Direct File pilot program, a new option that allows eligible taxpayers to file their federal tax returns online directly with the IRS for free, is currently available in 12 participating states.

Source: IRS-2024-95, April, 2024