More than $482 million recovered from 1,600 millionaires who have not paid tax debts

The Internal Revenue Service announced today continued progress to expand enforcement efforts related to high-income individuals, large corporations and complex partnerships as part of wider efforts to transform the agency.

IRS Commissioner Danny Werfel noted Inflation Reduction Act resources continue to help in a variety of areas. In addition to earlier announcements focusing on further improving taxpayer service during the upcoming 2024 filing season, the IRS has focused IRA resources on strengthening enforcement to pursue complex partnerships, large corporations and high-income, high-wealth individuals who do not pay overdue tax bills.

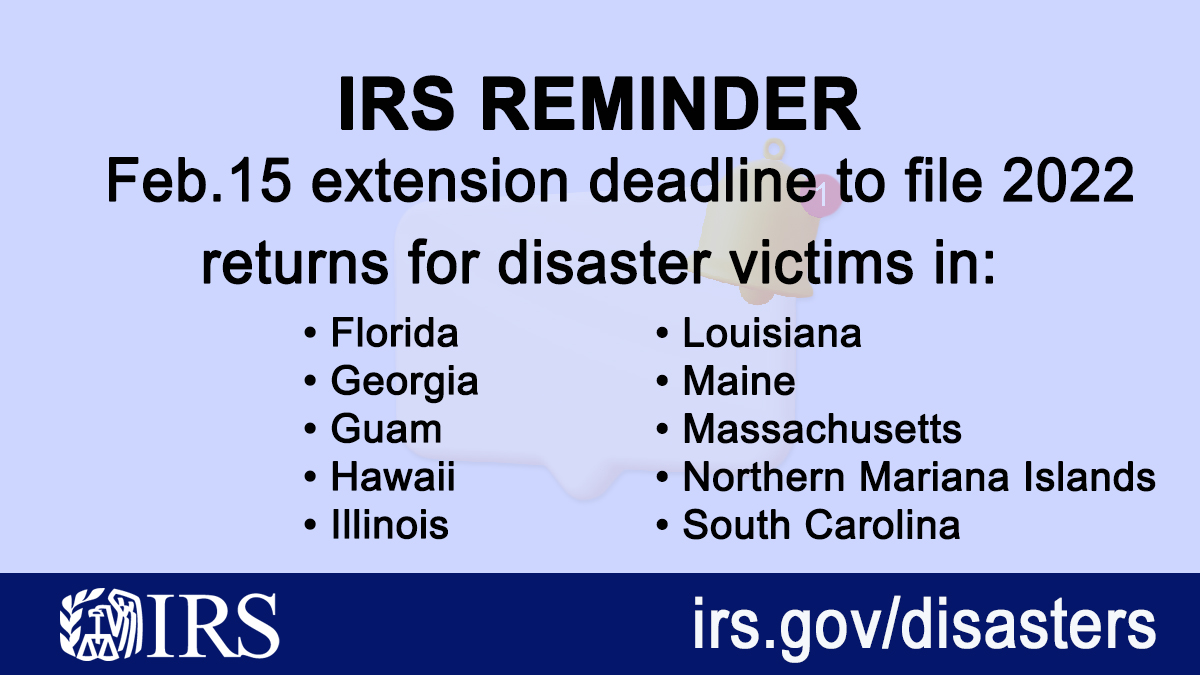

The IRS shared today progress in its focus on people using partnerships to avoid paying self-employment taxes as well as new details on current enforcement priorities. The IRS is also continuing to pursue millionaires that have not paid hundreds of millions of dollars in tax debt, with an additional $360 million collected on top of the $122 million reported in late October. The IRS has now collected $482 million in ongoing efforts to recoup taxes owed by 1,600 millionaires with work continuing in this area.

“The IRS continues to increase scrutiny on high-income taxpayers as we work to reverse the historic low audit rates and limited focus that the wealthiest individuals and organizations faced in the years that predated the Inflation Reduction Act. We are adding staff and technology to ensure that the taxpayers with the highest income, including partnerships, large corporations and millionaires and billionaires, pay what is legally owed under federal law,” Werfel said. “At the same time, we are focused on improving our taxpayer service for hard-working taxpayers, offering them more in-person and online resources as part of our effort to deliver another successful tax season in 2024. The additional resources the IRS has received is making a difference for taxpayers, and we plan to build on these improvements in the months ahead.”

Werfel highlighted these as part of a quarterly update on the IRS Strategic Operating Plan, the transformational effort using IRA funding. As these initiatives to improve compliance among high-income individuals, complex partnerships and large corporations increase, the IRS continues its work to improve customer service and modernize core technology infrastructure.

Ensuring complex partnerships, large corporations and high-income, high-wealth individual taxpayers pay taxes owed

The IRS is working to ensure large corporate, large partnership and high-income individual filers pay the taxes they owe. Prior to the Inflation Reduction Act, more than a decade of budget cuts prevented the IRS from keeping pace with the increasingly complicated set of tools that the wealthiest taxpayers use to hide their income and evade paying their share. The IRS is now taking swift and aggressive action to close this gap.

- Prioritization of high-income cases: The IRS has ramped up efforts to pursue high-income, high-wealth individuals who have either not filed their taxes or failed to pay recognized tax debt, with dozens of revenue officers focused on these high-end collection cases. These efforts are concentrated among taxpayers with more than $1 million in income and more than $250,000 in recognized tax debt. In an initial success, the IRS collected $38 million from more than 175 high-income earners. The IRS last fall began contacting about 1,600 new taxpayers in this category that owe hundreds of millions of dollars in taxes. The IRS has assigned over 900 of these 1,600 cases to revenue officers, with over $482 million collected so far. This brings the total recovered from millionaires through these new initiatives to $520 million.

- Pursuing multi-million-dollar partnership balance sheet discrepancies: The IRS has identified ongoing discrepancies on balance sheets involving partnerships with over $10 million in assets, which is an indicator of potential non-compliance. Taxpayers filing partnership returns are showing millions of dollars in discrepancies between end-of-year balances compared to the beginning balances the following year. The number of these discrepancies has been increasing, with many taxpayers not attaching required statements explaining the difference. The IRS announced an initiative to address the balance sheet discrepancy in September and as of the end of October had sent 480 compliance alerts.

- Ramp up of audits of 76 largest partnerships leveraging Artificial Intelligence (AI): The complex structures and tax issues present in large partnerships require a focused approach to best identify the highest risk issues and apply resources accordingly. In 2021, the IRS launched the first stage of its Large Partnership Compliance (LPC) program with examinations of some of the largest and most complex partnership returns in the filing population. The IRS announced in September that it would expand this program to additional large partnerships. With the help of AI, the selection of these returns is the result of groundbreaking collaboration among experts in data science and tax enforcement, who have been working side-by-side to apply cutting-edge machine learning technology to identify potential compliance risk in the areas of partnership tax, general income tax and accounting, and international tax in a taxpayer segment that historically has been subject to limited examination coverage. As of December, the IRS had open examinations of 76 of the largest partnerships in the U.S. that represent a cross section of industries including hedge funds, real estate investment partnerships, publicly traded partnerships, large law firms and other industries. On average, these partnerships each have more than $10 billion in assets.

- Large Foreign-Owned Corporations Transfer Pricing Initiative: The IRS is increasing compliance efforts on the U.S. subsidiaries of foreign companies that distribute goods in the U.S. and do not pay their fair share of tax on the profit they earn of their U.S. activity. These foreign companies use transfer pricing rules year after year to report losses that are engineered through the improper use of these rules to avoid reporting an appropriate amount of U.S. profits. To crack down on this strategy, as of mid-November the IRS has sent compliance alerts to more than 180 subsidiaries of large foreign corporations to reiterate their U.S. tax obligations and incentivize self-correction.

- Expansion of the Large Corporate Compliance program: The Large Business & International Division’s (LB&I) Large Corporate Compliance (LCC) program focuses on noncompliance by using data analytics to identify large corporate taxpayers for audit. LCC includes the largest and most complex corporate taxpayers with average assets of more than $24 billion and average taxable income of approximately $526 million per year. As new accountants come on board in early 2024, LB&I is expanding the program by starting an additional 60 audits of the largest corporate taxpayers selected using a combination of artificial intelligence and subject matter expertise in areas such as cross-border issues and corporate planning and transactions.

- Partnership Self-Employment Tax Initiative: As part of the agency’s increased focus on the tax issues applicable to partnerships and partners, the IRS has been increasing compliance to ensure that Self-Employment Contributions Act (SECA) taxes are being properly reported and paid by wealthy individual partners who provide services and have inappropriately claimed to qualify as “limited partners” in state law limited partnerships (such as investment partnerships) not subject to SECA tax. In contrast to wage earners whose employment taxes (Federal Insurance Contributions Act/FICA) are deducted from their paychecks, self-employed individuals are required to report and pay their SECA taxes on their federal income returns. The IRS efforts to date include over 80 audits of wealthy individuals. Additionally, in November 2023, the Tax Court issued an opinion in Soroban Capital Partners LP v. Commissioner that agreed with the IRS’s position that the limited partner exception to SECA tax does not apply to a partner who is “limited” in name only. As a result, partners who actively participated in the state law limited partnership must report their partnership share as net earnings from self-employment subject to SECA tax.

New examples of cases closed since the Inflation Reduction Act passed follow:

- In January 2024, two individuals were sentenced to 25 years and 23 years respectively in prison for conspiracy to commit wire fraud, aiding and assisting the filing of false tax returns and money laundering for their role in promoting a fraudulent tax shelter scheme involving syndicated conservation easements.

- In December, a Swiss Bank entered into a Deferred Prosecution Agreement (DPA) and agreed to pay approximately $122.9 million to the U.S. Treasury for their role in assisting U.S. taxpayer-clients with evading their U.S. taxes by opening and maintaining undeclared accounts. The bank also maintained accounts of certain U.S. taxpayer-clients in a manner that allowed them to further conceal their undeclared accounts from the IRS. In total, from 2008 through 2014, the bank held 1,637 U.S. Penalty Accounts, with aggregate maximum assets under management of approximately $5.6 billion in January 2008, on behalf of clients who collectively evaded approximately $50.6 million in U.S. taxes.

- In December, an individual was sentenced to 10 years and 10 months and ordered to pay more than $130,000 in restitution, another was sentenced to 102 months in prison and ordered to pay more than $2.5M in restitution and a third individual was sentenced to four years in prison and ordered to pay more than $2.5M in restitution for their involvement in a RICO Conspiracy for cyber intrusion and tax fraud. These individuals used the dark web to purchase server credentials for the computer servers of Certified Public Accounting and tax preparation firms across the country.

- In December, an individual was sentenced to 28 months in federal prison and ordered to pay over $470,000 in restitution to the IRS for filing a false tax return while working as a money mule for romance scams. The individual opened and maintained bank accounts to collect proceeds from the schemes and to send the money to himself and others overseas.

- An individual was sentenced to 57 months in prison for their failure to pay more than $1.35 million of taxes arising from their operation of several restaurants in the Washington, D.C. area. The individual evaded taxes by concealing assets and obscuring the large sums of money they took from the businesses by purchasing property in the name of a nominee entity and causing false entries in the businesses’ books and records to hide personal purchases using business bank accounts.

Hiring additional top talent to pursue high-income individuals, complex partnerships and large corporations

The IRS offered positions to more than 560 new skilled accountants in November and December, key positions in ramping up work to pursue high-wealth individuals, complex partnerships and large corporations that do not pay taxes owed. Importantly, the IRS has been modernizing its hiring processes and holding more direct hiring events to better compete with the private sector and quickly bring top talent on board.

For example, at a December hiring event in Houston, the IRS hired 160 skilled accountants in two days, compressing the typical three to six month hiring process into one day. These events are marketed in advance, and onsite Human Capital Office staff review all applicants’ credentials and ensure they are qualified for the position. Following this initial screening, applicants are interviewed by hiring managers and passed to selecting officials for a final decision. Successful applicants are given tentative offers, sponsored and fingerprinted on site, leaving only background and tax checks to be completed.

Improving taxpayer service

The IRS is focused on helping taxpayers get it right the first time — claiming the credits and deductions they are eligible for and avoiding back-and-forth with the agency when errors arise. To help taxpayers get it right, the IRS is working toward taxpayers being able to seamlessly interact with the agency in the ways that work best for them on the phone, in-person and online. The IRS is expanding in-person service and meeting taxpayers where they are, particularly those in underserved and rural communities. The IRS is continuing to expand Taxpayer Assistance Centers across the country.

- Opening Taxpayer Assistance Centers: Currently, the IRS has opened or reopened 54 Taxpayer Assistance Centers since the passage of the Inflation Reduction Act, including four since November:

- Bellingham, Washington

- Eau Claire, Wisconsin

- Washington, Pennsylvania

- Media, Pennsylvania

Taxpayer Assistance Centers, which provide in-person support to local communities across the country, will collectively offer over 8,000 more hours of in-person assistance than they did last filing season.

- Taxpayer Assistance Center hiring update: As of the end of December, the IRS has hired 858 employees to staff Taxpayer Assistance Centers. This represents a 410 net increase in Taxpayer Assistance Center staffing compared to Fiscal Year 2022, and IRS continues to hire to replace departing staff.

Taxpayers deserve the same functionality in their online accounts that they experience with their bank or other financial institutions. As detailed in the Strategic Operating Plan, in the next five years, taxpayers will be able to securely file all documents and respond to all notices online and securely access and download their data and account history. The IRS has hit or has in progress several milestones toward this goal, including the launch of Business Tax Account, the expansion of the Document Upload Tool to accept responses to nearly all notices and letters, and the launch of digital mobile-adaptive forms.

- Respond to notices online: Taxpayers are now able to respond to notices online. Until Filing Season 2023, when taxpayers received notices for things like document verification, they had to respond through the mail. During Filing Season 2023, taxpayers were able to respond to 10 of the most common notices for credits like the Earned Income and Health Insurance Tax Credits online, saving them time and money. By July 2023, taxpayers had the option to respond to 61 IRS notices and letters, and by October 2023, taxpayers could respond to all notices and letters that do not have a filing or payment action. As of December, the IRS has received more than 45,000 responses to notices via the online tool.

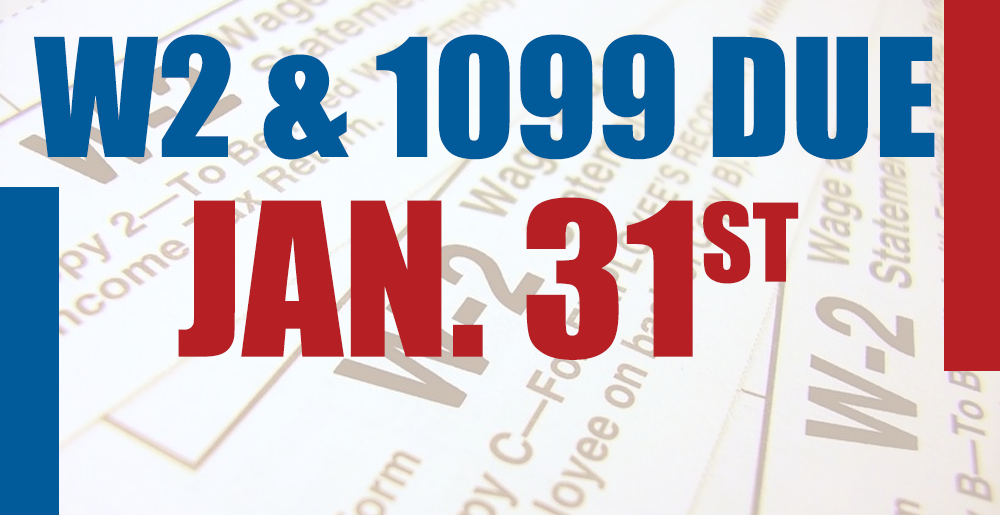

- Processing Status for Tax Forms dashboard: The IRS has launched a public facing Processing Status for Tax Formsdashboard listing current processing status for key forms (e.g., 1040, 941) and general correspondence. The IRS operations: Status of mission-critical functions webpage has also been updated to link to the new dashboard. For electronically filed forms, processing status is the typical number of days it currently takes to process a form after receipt from the taxpayer. For paper forms, processing status reflects which month of receipt is currently being processed. The IRS included forms that had significant volumes of submission in paper format and lead to a follow-on action for the taxpayer after submissions are processed. For example, forms that trigger refunds or the receipt of an Individual Taxpayer Identification Number (ITIN). The page is updated weekly to reflect current processing status.

- Voice bots on Where’s My Refund? and Where’s My Amended Return?: IRS launched natural voice language voice bots for taxpayers calling about refunds and amended returns. These voice bots allow callers to ask questions using natural language instead of following menu-driven prompts.

In addition, the IRS continues to expand the functionality of several online platforms:

- With the latest updates to Individual Online Account, individuals can now save multiple bank accounts, validate bank account information and display their bank name. Individuals can also schedule and cancel payments and expand and revise payment plans.

- The IRS launched the second phase of Business Tax Account that expands its capabilities and eligible entity types. As a result, individual partners of partnerships and individual shareholders of S corporation businesses are now eligible for a business tax account, in addition to sole proprietors with an employer identification number (EIN). Eligible entities can now access business tax transcripts and view digital notices and letters.

- Enhancements to Tax Pro Account include the ability to manage active client authorizations with the Centralized Authorization File (CAF) database, view and manage active authorizations, and view their individual and business clients’ tax information including business balance due and canceled and returned checks for individuals.

Modernizing technology

On the technology side, the IRS is modernizing decades-old technology to drive the agency’s efforts to provide world-class customer service and protect taxpayers’ data.

- Digitalization: The IRS also continues to make significant progress scanning and e-filing paper returns. By the end of February, the IRS will have replaced scanning equipment that is older than five years and the automated mail-sorter machines in the six highest-volume locations, streamlining the process of mail sorting, opening and scanning. As of the end of December, the IRS had scanned more than 1.5 million forms during the 2023 calendar year — more than 484,000 Forms 940, 907,000 Forms 941 and more than 111,000 Forms 1040. Digitization has far-reaching implications for how the IRS can improve service.

Source: IRS-2024-09, Jan. 12, 2024