National Taxpayer Advocate Erin M. Collins today released her Fiscal Year 2026 Objectives Report to Congress, highlighting a largely successful 2025 filing season while raising concerns about persistent refund delays for victims of identity theft, delays in processing Employee Retention Credit claims, and critical challenges facing taxpayers and the IRS as the agency prepares for the 2026 filing season. The report also outlines the Advocate’s priority recommendations as the IRS continues to modernize its technology systems.

“The 2025 filing season was one of the most successful filing seasons in recent memory,” Collins said in releasing the report. “But with the IRS workforce reduced by 26% and significant tax law changes on the horizon, there are risks to next year’s filing season. It is critical that the IRS begin to take steps now to prepare.”

The 2025 filing season generally ran smoothly

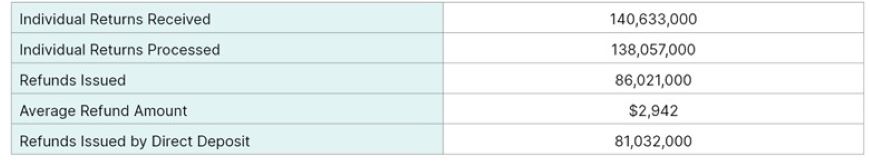

The IRS received nearly 141 million individual income tax returns and processed about 138 million. Over 95% of processed returns were filed electronically, and about 62% resulted in refunds. Figure 1 shows key filing season statistics.

Figure 1: Individual tax return statistics for the 2025 filing season

The IRS processed most returns without issues. However, the IRS “suspended” over 13 million returns during processing pending additional review, and these processing delays generally translated into refund delays for the affected taxpayers.

Refund delays for identity theft victims remain a serious concern

One longstanding filing season challenge that remains unresolved is lengthy delays in resolving identity theft cases. There are two categories of identity theft cases. One involves returns that IRS return processing filters flag as potential identity theft; the IRS flagged about 2.1 million such returns. In these cases, the IRS sent a letter to taxpayers notifying them they had to authenticate their identities before receiving their refunds. The IRS typically takes several months to resolve these cases.

In the second category of identity theft cases, a thief has stolen a taxpayer’s identity and filed a tax return using the taxpayer’s name and Social Security number. These taxpayers are victims and may also be experiencing the effects of identity theft beyond the context of their tax returns. Their cases are referred to the IRS’s Identity Theft Victim Assistance (IDTVA) unit for resolution.

As of the end of the filing season, the IRS had about:

- 387,000 IDTVA cases in inventory, and

- the cases were taking an average of about 20 months to resolve.

“These delays disproportionately affect vulnerable populations dependent on their refunds to meet basic living expenses,” the report says. In fiscal year (FY) 2023, 69% of affected taxpayers had adjusted gross incomes at or below 250% of the Federal Poverty Level.

“IRS leadership has repeatedly assured TAS that reducing cycle time for IDTVA cases is a top priority, yet the cycle time remains unacceptably long,” Collins wrote. “I continue to urge the agency to focus on dramatically shortening the time it takes to resolve IDTVA cases, so it does not force victims, particularly those dependent on their tax refunds, to wait nearly 2 years to receive their money.” The report recommends that the IRS reduce the average case resolution time to 4 months.

Operational risks remain a concern as the 2026 filing season approaches

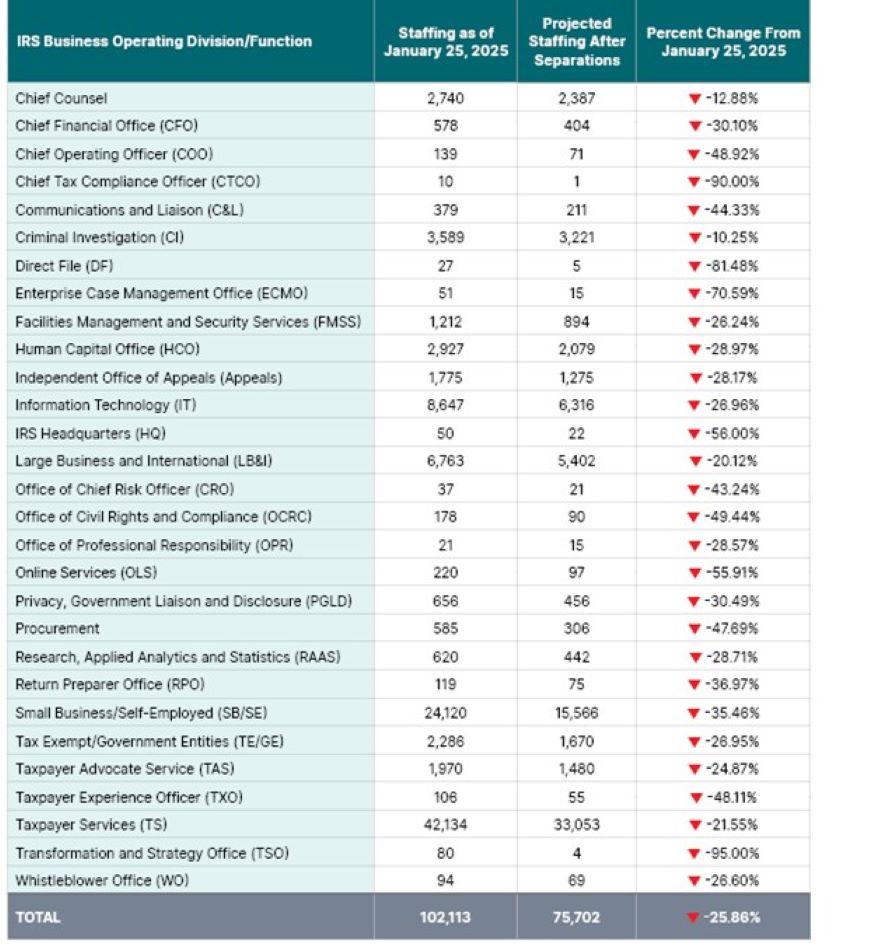

Collins warned that without improved technology in place, IRS staffing cuts could jeopardize the success of next year’s filing season. To deliver a successful filing season, the IRS needs a sufficient number of trained employees to program its processing systems, develop and disseminate timely and clear guidance on tax law changes, answer telephone calls and process correspondence, among other things. See Figure 2 for staffing reductions by business unit.

Between the start of the 2025 filing season and June, the IRS workforce decreased from about 102,000 employees to fewer than 76,000, a drop of about 26% (after taking into account employees who accepted an early resignation offer but will remain on rolls through September 30).

Figure 2: IRS personnel losses by business unit (as of June 4, 2025)

The report notes that the IRS’s Information Technology (IT) and Taxpayer Services business units play critical roles in delivering a successful filing season. IT personnel must reprogram IRS processing systems to reflect changes in law, while Taxpayer Services personnel are responsible for processing tax returns, answering telephone calls, and processing correspondence.

As of this month, as Figure 2 shows, IT staffing has been reduced by 27%, and Taxpayer Services staffing has been reduced by about 22%, or by more than 9,000 employees. The Administration’s FY 2026 budget proposal calls for keeping Taxpayer Services staffing at about FY 2025 levels (taking into account both appropriated funds and Inflation Reduction Act funds). Thus, the IRS will need to rapidly hire and train thousands of new Taxpayer Services employees before the 2026 filing season to process returns and deliver timely refunds.

“With the 2026 filing season on the horizon amid potential legislation changes and continued staffing constraints,” Collins wrote, “early preparation is essential to ensure the IRS can deliver both effective taxpayer service and secure operations.”

IRS should prioritize three taxpayer-focused IT projects

The report applauds recent progress in IRS technology modernization but urges the agency to stay focused on taxpayer-facing improvements. Collins highlights the IRS’s longstanding challenges in managing antiquated technology systems and recent efforts to modernize its systems. In collaboration with the Treasury Department and the Department of Government Efficiency, the IRS established nine distinct modernization “verticals” (i.e., technology projects designed to meet specific needs). Among them are a unified application programming interface, digitalization of paper returns and correspondence, and improved system interoperability among the agency’s roughly 60 stand-alone case management systems.

“For several decades, the holy grail of tax administration has been developing and deploying technology systems that automate key IRS functions in a way that improves taxpayer service and compliance and reduces the need for a large workforce,” the report says. “The IRS has made notable strides during the last couple of years, and the Treasury Department’s leadership has committed to continue accelerating the IRS’s IT progress.”

Citing the adage, “If everything is a priority, nothing is a priority,” the report recommends that the IRS “focus its efforts on a manageable number of projects that provide the greatest value to taxpayers, employees, and the tax system while ensuring that taxpayers are not harmed during the transition period.”

The report recommends that the IRS adopt a “digital first” approach to taxpayer service and prioritize three projects:

1. Creating fully functional online accounts. Collins said the IRS’s number one priority should be to enhance online accounts so taxpayers and tax professionals can view all relevant information and conduct all transactions with the IRS through their accounts.

“The IRS should continue to prioritize providing online functionality that mirrors the robust functionality offered by banks and other financial institutions,” the report says. “For at least two decades, most of us have been able to conduct almost all our financial activity using online accounts. At banks, that includes making deposits, paying bills, transferring funds between accounts, and even applying for mortgages and home equity lines of credit. At brokerages, it includes buying and selling stocks and securities. With our credit card companies, it includes paying bills, monitoring charges, disputing charges, and paying off balances.”

By contrast, the functionality of IRS online accounts is limited. Taxpayers generally cannot file tax returns, view most notices, or respond to notices through their online accounts. Until recently, they could not make payments. As a result, only about 10% of taxpayers have taken the time to establish online accounts.

“The IRS must do more,” Collins wrote. “I believe the IRS’s top technology priority should be to allow taxpayers to conduct all transactions with the IRS from the ‘one-stop shop’ of an online account, just as they can with other financial institutions.”

2. Digitizing the processing of paper-filed tax returns, correspondence, and other documents. The IRS estimates it will receive about 43 million paper tax returns and 19 million paper information returns in 2025, as well as millions of responses to the roughly 170 million paper notices it sends to individual taxpayers each year.

IRS employees manually transcribe data from paper-filed tax returns, digit by digit, into IRS systems. The IRS has allowed taxpayers to upload their responses to IRS notices through a digital “Document Upload Tool,” but it does not have a way to process responses using automation. As a result, it generally must print taxpayer responses and route them to IRS employees for processing as if they had been submitted on paper.

“True modernization would provide an IT solution from the time the paper arrives at the IRS through the backend processing of the return or correspondence.” Collins wrote.

3. Integrating about 60 case management systems. The report says the IRS currently stores taxpayer data on about 60 distinct case management systems that generally cannot communicate with each other. As a result, a taxpayer who calls the IRS to discuss an account issue may find the customer service representative (CSR) who answers lacks access to the relevant account information or must open multiple case management systems on different screens and toggle among them to answer questions.

“[A] call to a CSR can take much longer than it should,” the report says. “The CSR may have to put the taxpayer on hold multiple times to launch different systems and ultimately may still not be able to access the system relevant to the taxpayer’s issue, requiring a transfer or a call to a different IRS function. This fragmentation contributes to poor customer service and taxpayer frustration.”

Under an initiative known as Taxpayer 360, the IRS addressed these limitations by creating an integrated case management system that consolidates all relevant information a CSR may need to help taxpayers in a single database. “Given that the IRS handles approximately 100 million telephone calls each year, giving CSRs faster and more complete access to taxpayer data would go a long way toward improving the timeliness and effectiveness of telephone service,” the report says. It recommends the IRS continue to prioritize this initiative.

Taxpayer Advocate Service advocacy objectives for FY 2026

The report identifies TAS’s key advocacy objectives for the upcoming fiscal year as law requires. The report sets out nine such objectives:

- Improve automation and metrics to enhance the taxpayer experience;

- Expand IRS online account functionality;

- Reduce Identity Theft Victim Assistance resolution time from nearly 2 years to 4 months;

- Strengthen IRS oversight of unethical tax return preparers;

- Expedite the resolution of Centralized Authorization File number suspensions to protect tax professionals and taxpayers;

- Complete processing of all Employee Retention Credit claims and ensure taxpayer rights are protected;

- Improve responses to Freedom of Information Act requests;

- Strengthen Appeals’ independence and operational efficiency; and

- Improve the IRS’s criminal voluntary disclosure practice.

The IRS agrees to implement most of the proposed administrative recommendations

The National Taxpayer Advocate is required by law to submit a year-end report to Congress that, among other things, makes administrative recommendations to resolve taxpayer problems. Internal Revenue Code § 7803(c)(3) authorizes the National Taxpayer Advocate to submit the administrative recommendations to the Commissioner and requires the IRS to respond within 3 months.

The National Taxpayer Advocate made 77 administrative recommendations in her 2024 year-end report and then submitted them to the Commissioner for response. The IRS has agreed to implement 42 (or 55%) of the recommendations in full or in part.

Read the IRS responses in the 2024 Annual Report to Congress Report Card (PDF). PDF

The National Taxpayer Advocate is required by statute to submit two annual reports to the House Committee on Ways and Means and the Senate Committee on Finance. The statute requires the reports to be submitted directly to the Committees without any prior review or comment from the Commissioner of Internal Revenue, the Secretary of the Treasury, the IRS Oversight Board, any other officer or employee of the Department of the Treasury or the Office of Management and Budget. The first report must identify the objectives of the Office of the Taxpayer Advocate for the fiscal year beginning in that calendar year. The second report must include a discussion of the 10 most serious problems encountered by taxpayers, identify the 10 tax issues most frequently litigated in the courts and make administrative and legislative recommendations to resolve taxpayer problems.

The National Taxpayer Advocate blogs about key issues in tax administration. Individuals may subscribe to the blog and read past posts.

For media inquiries, please contact TAS Media Relations at tas.media@irs.gov or call the media line at 202-317-6802.

About the Taxpayer Advocate Service

TAS is an independent organization within the IRS. TAS helps taxpayers resolve problems with the IRS, makes administrative and legislative recommendations to prevent or correct the issues and protects taxpayer rights.

To learn move visit: Taxpayer Advocate Service or call 877-777-4778. Get updates on tax topics by following TAS on social media: Facebook, X, LinkedIn and YouTube.

Source: IRS